Always check your state Medicaid coverage on Medicaid.gov for the most up-to-date coverage information.

What Are Other Hearing Aid Coverage Options?

Sifting through what insurance providers do and do not cover takes time. The following resources may help you find more options to help reduce the cost of your hearing aids.

The Department of Veterans Affairs Coverage

The Department of Veterans Affairs (VA) provides free hearing aids, as well as coverage for equipment adjustments, battery replacement, and cleaning. The VA also provides compensation for tinnitus for those who qualify. You must be enrolled in the VA health benefits program to be eligible for coverage.

AARP Hearing Aid Discounts

AARP members receive discounts on hearing aids and hearing health services through UnitedHealthcare Hearing. AARP hearing aid discounts include:

- 20% off prescription hearing aids

- 15% off hearing accessories

- Free hearing test and consultation

- Discounted prices for OTC hearing aids

AARP members are also eligible for a free, at-home, hearing screening from The National Hearing Test once a year.

Using FSA or HSA Funds

Hearing aids can be purchased with flexible spending account (FSA) or health savings account (HSA) funds. Both account types allow you to set aside pretax money to pay for certain medical expenses. You can sign up for an FSA or HSA through your employer.

FSA funds are lost if you do not spend them by the end of the year. You also can’t access funds after retirement. If you’re retiring in the next few years, plan ahead by using your FSA funds to purchase hearing aids.

An HSA is only available if you have a high-deductible health insurance plan. HSA funds roll over into the next year. You can access your HSA account and contribute to it after you retire, as long as you’re not enrolled in Medicare.

Financing Options

Many hearing care providers offer financing for hearing aids and hearing health services. Financing allows you to pay for your hearing aids over time instead of all at once.

Two common financing options are CareCredit and the Wells Fargo Health Advantage® credit card program. You must apply and be approved by CareCredit or Wells Fargo Bank to use this payment option.

You can use CareCredit for the following hearing products and services:

- Audiology appointments

- Earmolds

- Hearing devices

- Hearing tests

- Implants

- Regular hearing check-ups

- Regular hearing device re-fittings

- Tinnitus treatment

The Wells Fargo Health Advantage® credit card can be used for the following:

- ENT procedures

- Hearing aids

- Hearing aid accessories

- Hearing exams

Both programs have interest-free financing for a “promotion period.” If you pay off your hearing aids within the set promotion period—usually 12 months or less—you don’t have to pay interest on top of your monthly payments.

If you don’t pay off your full balance by the end of the promotion period, you will also have to pay the accumulated interest from the date of purchase.

Confirm with your hearing care provider if they accept Care Credit, Wells Fargo Health Advantage® credit card, or other financing options before applying.

Faivre pointed out that some online sales from clinics are starting to offer various payment options that are common in retail, such as paying in four installments.

Dr. Magann Faivre also encouraged shoppers to research local loan programs for hearing aids, “Most states have a loan program that rivals or beats CareCredit or Wells Fargo that’s specifically made for people who need medical loans. In Oklahoma, a local bank in conjunction with one of our state universities does this.

“It can be advantageous when people have bad credit, need financing for a low amount (under about $300), or need financing for three or more years. A local audiologist should be able to point people towards these types of local resources available.”

Bottom Line

Hearing aids help you reconnect with your loved ones and your surroundings. More than 87% of our survey respondents consider their hearing aids a worthwhile purchase.

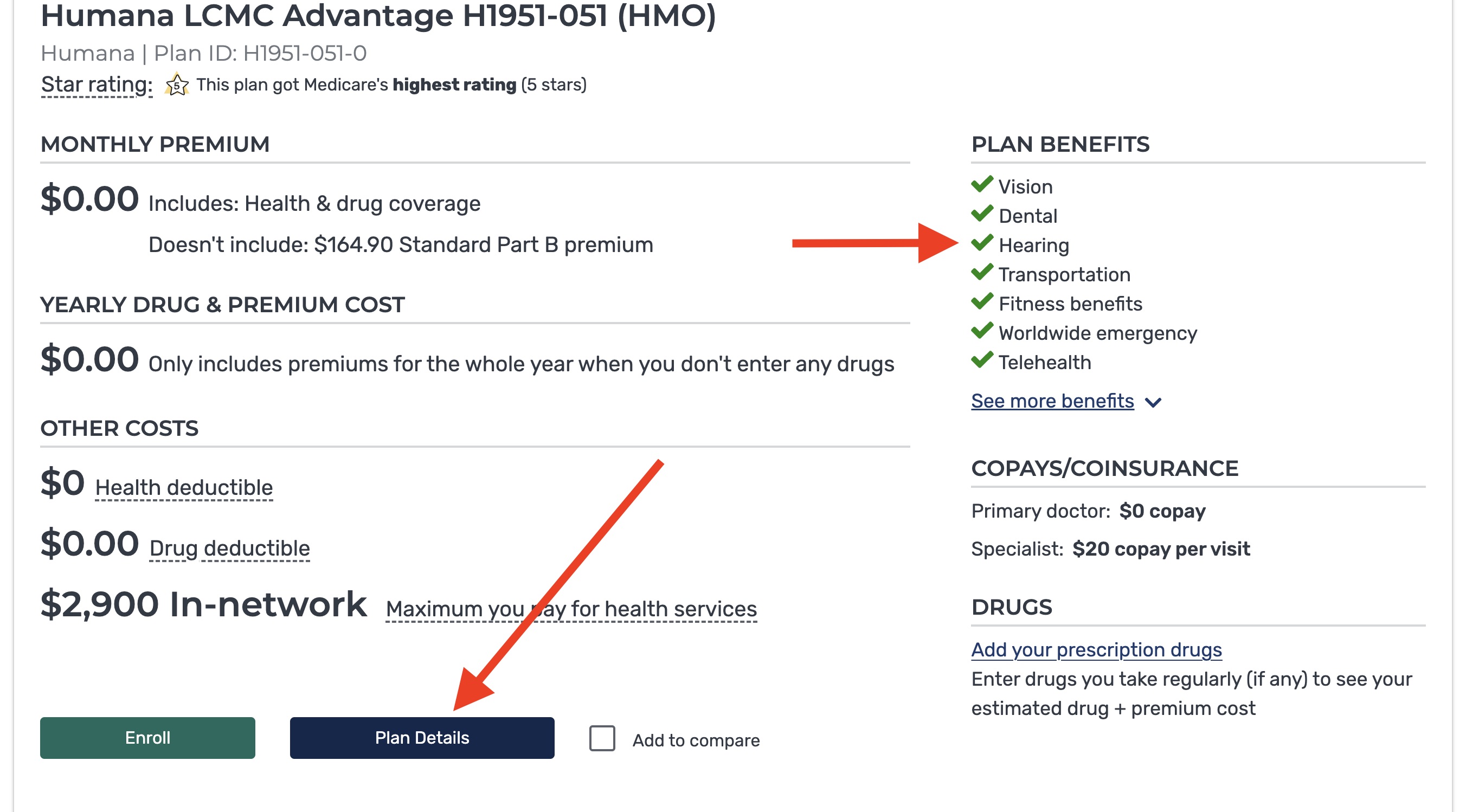

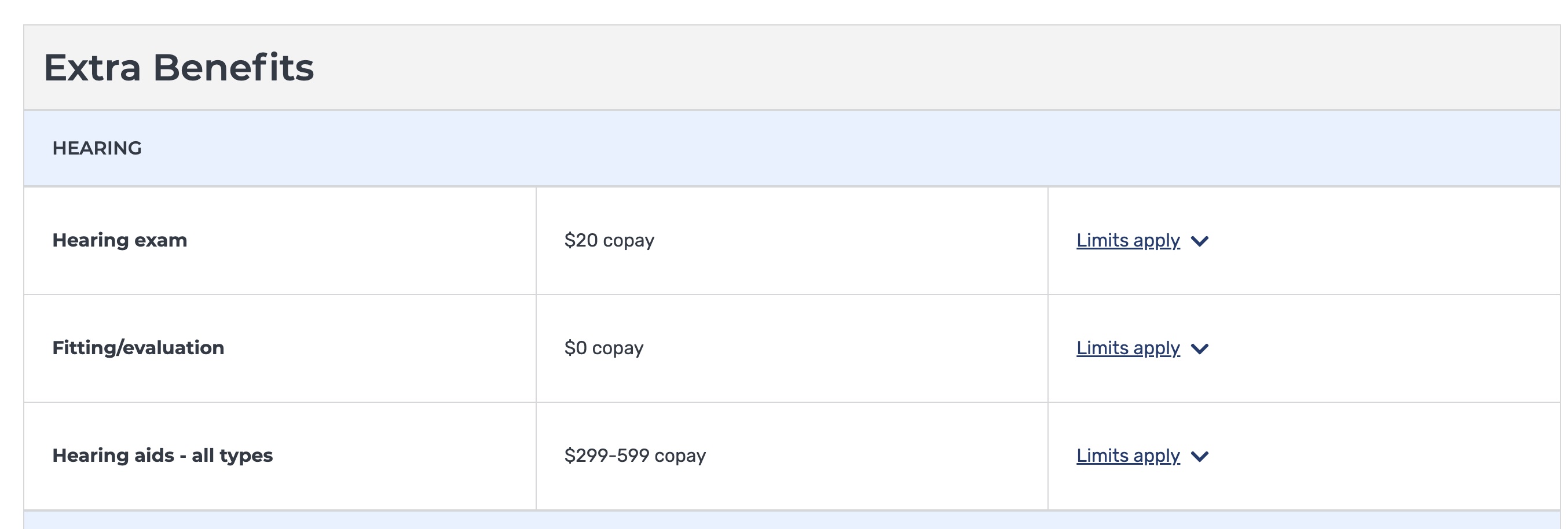

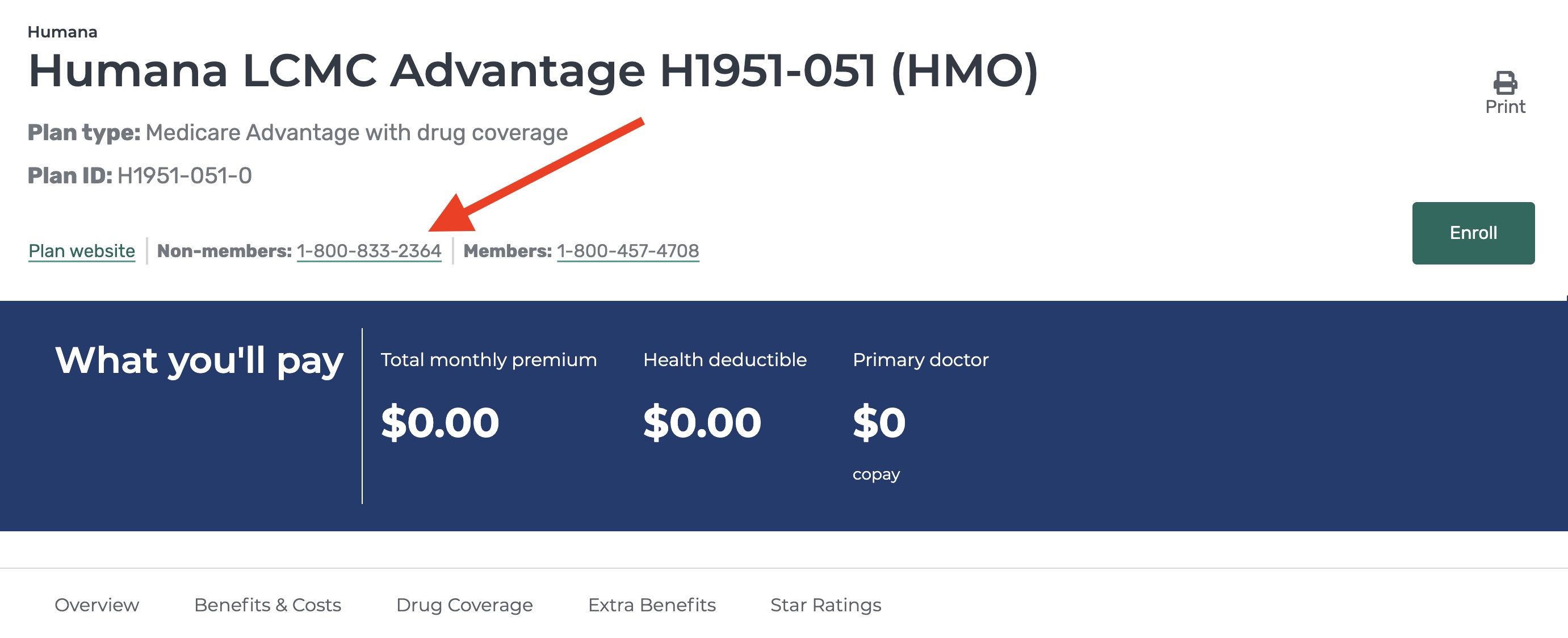

Depending on your eligibility, you may receive hearing aid coverage through Medicare Advantage or Veterans Affairs.

Noninsurance options, such as being an AARP member, using FSA or HSA funds, or paying with interest-free financing, can reduce the cost of the best hearing aids.

Hearing aid coverage is also available for Cherokee Nation citizens. The Hearing Aid Expansion Act of 2022 extended the Cherokee National Health Service’s hearing aid program to Cherokee Nation citizens located anywhere in the US. Eligible citizens can receive two free hearing aids.