Medically Reviewed by: Christopher Norman, Board Certified Nurse Practitioner (NP)

Key Takeaways

- Medicare will not cover the cost of assisted living. Medicaid can cover personal and medical care received in assisted living, but it typically will not cover the cost of room and board.

- Monthly fees for assisted living facilities are subject to change. The cost will likely go up as the level of care you need increases.

- There are many ways to cover the cost of assisted living, including personal savings, long-term care insurance, home equity, and Medicaid waivers.

As adults get older, the right living situation is key to promoting independence and maintaining a healthy lifestyle. The first step is determining the kind of environment you want to live in and the level of care you need. If you’re seeking a community setting with the added benefits of around-the-clock care and help with activities of daily living (ADLs), assisted living might be a good fit.

Next, it’s time to think about your budget. In order to make a decision, you need an accurate picture of the monthly cost of assisted living. While safety and quality of care are important, we know that cost cannot be ignored in your search for long-term care. In the AgingInPlace.org (AIP) Reviews Team’s March 2023 Senior Living Survey, nearly 70% of respondents cited cost as one of the most important aspects of their search for senior living options.

This guide will help you navigate the landscape of assisted living costs and determine if assisted living is the right choice for your needs and your budget.

Why You Can Trust Us

Our team works hard to provide clear, transparent information to older adults seeking senior living and home care. To provide you with the best possible information, we have spent more than 250 hours:

- Consulting with our advisory board, which consists of a certified life care manager, a board-certified geropyschologist, and a geriatric nurse practitioner

- Analyzing and synthesizing nationwide data from the Centers for Medicare & Medicaid Services and the National Investment Center for Seniors Housing & Care

- Analyzing and synthesizing state-specific data from government health regulatory agencies

- Surveying thousands of seniors and their caregivers about their search for assisted living facilities

- Conducting focus groups with caregivers who are helping older adults find senior living

- Mystery shopping dozens of brands and facilities associated with long-term care for seniors

Cost of Assisted Living: The Big Picture

There are a few key factors for seniors and their caregivers to understand about the cost of assisted living in the United States:

- Medicare does not cover any form of long-term care. Medicaid may cover some of the services provided in assisted living, but it will not cover the cost of room and board. This means assisted living facilities are primarily private-pay.

- While some assisted living communities offer all-inclusive pricing, the monthly fee cited by most facilities is the base fee for room and board only. Potential residents need to ask about the additional fees for services, such as assistance with ADLs. In most cases, the more care you need, the more expensive assisted living will be.

- Many assisted living facilities lack transparency about their pricing, an issue that has caused national consumer advocacy organizations to take note. Consumer Reports, for example, cites transparency in pricing as one of the six protections consumers need to improve care in assisted living. Similarly, the National Center for Assisted Living cites clear explanations of financial policies as one of their three guiding principles for providing information to consumers.

- For some low-and middle-income Americans, the price of assisted living may be prohibitive. It’s important to know that there are alternatives to assisted living, such as in-home care.

- Assisted living can be a wonderful living experience for many seniors. It’s best to begin your search for assisted living with a wealth of information that empowers you to make informed decisions about your future care.

The Cost of Assisted Living in the United States

The median cost of assisted living in the United States is $4,500 per month. There are no federal guidelines for assisted living, and all facilities are regulated on a state level. This means that services available in each facility—and the corresponding fees for those services—will vary widely from state to state.

Monthly Base Fee

Though some assisted living facilities offer all-inclusive, tiered pricing based on your needs, most will offer a base fee and then add additional fees based on the kind of care you require. The base assisted living fee generally covers the following aspects of assisted living:

- Cost of private studio or shared apartment

- Three meals per day, plus snacks

- Regular housekeeping, which may include laundry services

- Access to social activities within the community

Services that include help with ADLs, physical or occupational therapy, and medication management are usually not included in this base fee.

In addition to the monthly base fee, some assisted living facilities will charge a one-time community fee at move-in. This fee will vary based on your location and the type of facility. Three facilities we talked to in Greenville, South Carolina; Houston, Texas; and Columbus, Ohio, had community fees of $2,500, $2,000, and $1,500, respectively. These fees are usually not refundable.

Additional Care Costs

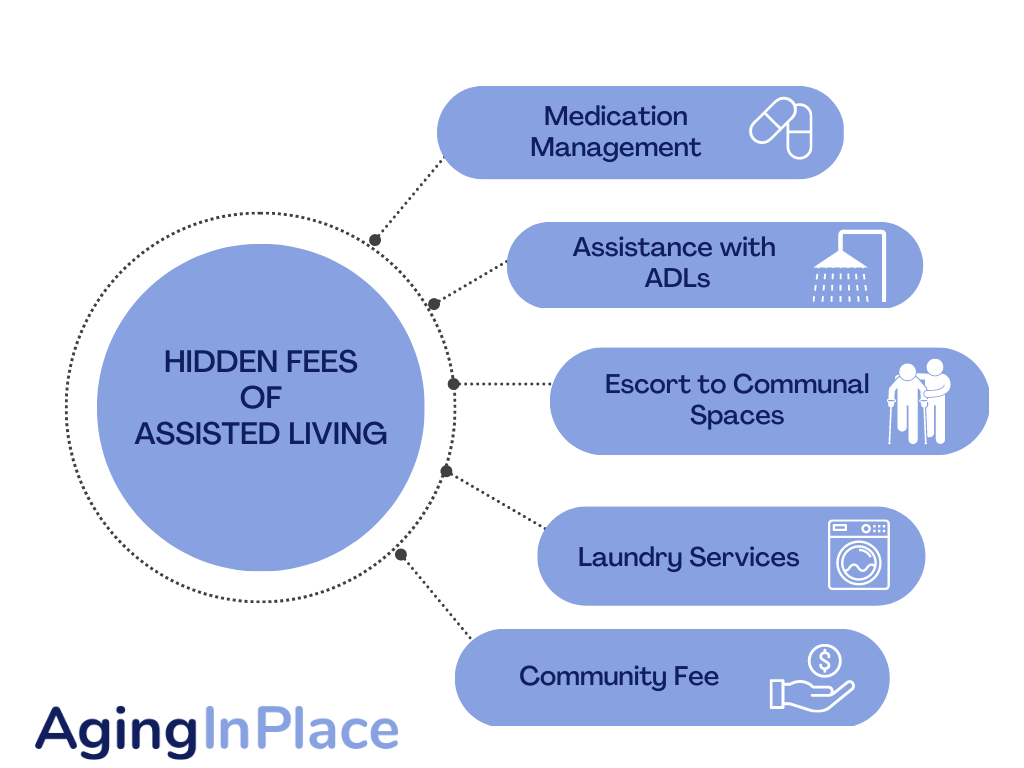

The added costs of assisted living are usually associated with the personal and medical care each resident receives. The more care you need, the more additional fees you will incur. These fees sometimes come as a surprise to assisted living residents, so it’s important to begin your assisted living experience with an understanding of how fees for additional services work.

If you enter assisted living with the ability to manage most ADLs on your own, your monthly expenses may not exceed the facility’s base fee. However, you may require more care as time goes on, which could increase the amount you pay each month.

These are the services that often incur additional monthly fees in assisted living facilities:

- Medication management

- Help with ADLs, like bathing, dressing, and bathroom care

- Escorts to and from communal spaces

- Some housekeeping services, like laundry, that may not be included in the base fee

- Social activities that go beyond the scope of the facility, such as a visit to a local museum or movie theater

Assisted Living Payment Structures

In most assisted living facilities, the amount of care you need will determine how much you pay each month.

According to Jennifer Avila, executive director of Chicago’s Custom Home Care, a nurse will assess the resident before moving into the facility to determine if the resident is appropriate for assisted living according to the state health department guidelines. The assisted living community will then tell the resident and family where they fall in the levels of care. Most facilities will reassess residents a month or so after a new resident has settled into the community, which means that the resident’s rate is subject to change. “Ask about the highest levels of care or maximum rate the facility charges, even if the resident is fairly independent now,” Avila recommended. “A health incident can happen at any time, and that will affect the monthly service fee.”

If the assisted living facility you choose uses tiered pricing, like one facility we researched in Grand Rapids, Michigan, the resident will be placed in an all-inclusive price bracket based on their care needs. This facility had three tiers based on the services needed by each resident, with a monthly Tier One fee of $5,100 and a monthly Tier Three fee of $6,700. With tiered pricing, the cost of personal care is rolled into the monthly fee for room and board.

If the assisted living facility you choose uses a la carte pricing, you’ll be charged by the number of services you receive each day. For example, if a resident is incontinent they may be subject to an additional daily or monthly charge for the additional time the staff will need to spend caring for them.